Additionally states also levy Value Added Tax VAT. All HS Codes or HSN Codes for petrol with GST Rates HSN Code 1201 GITANKS Products Include.

How Many Tax Codes Have Multiple Rates And Where

For petrol and diesel to be brought under GST the rates would have.

. The excise duty on petrol is approximately 1948 per litre and 1533 per. GST HS Code and rates for Diesel n petrol Serach GST hs code and tax rate Showing Result for Diesel n petrol Find GST HSN Codes with Tax Rates Here you can search HS Code of all products we have curated list of available HS code with GST website. The tax structure for petrol and diesel is likely to be a peak tax rate of 28 per cent plus states levying some amount of local sales tax or.

Is GST claimablereportable on BAS. Analysis of GST on petrol Diesel. In the current scenario the excise duty and average VAT percentage of different states come nearly to Rs.

What happens if GST implement on petrol diesel GST was introduced on 1st April 2017 at that time petroleum products were kept out of the preview of GST us 9 2. Electrically operated vehicles including two and three wheeled electric motor vehicles. Highlights of the GST rule on gas Domestic cylinder prices have gone up by about Rs32 per cylinder.

At 28 per cent GST the petrol and diesel will be sold at cheaper than the current rate for one litre of the fuel. Ronatbas Ultimate Partner 4552 Posts. Excise duty and VAT or value added tax.

Currently both central and state governments levy taxes on petrol and diesel ie. Gi Metal Water Storage Tank HSN Code 2705 Coal gas water gas producer gas lean gas and similar gases excluding petroleum gases and other gaseous hydrocarbons HSN Code 2709 Petroleum oils and oils obtained from bituminous minerals crude HSN Code 2710. The tax rates are classified under 0 5 12 18 and 28 GST.

G1 Total sales 1A GST on sales. Paraffin wax microcrystalline petroleum wax slack wax ozokerite lignite wax peat wax other mineral waxes and similar products obtained by synthesis or by other processes whether or not coloured excluding petroleum jelly and paraffin wax containing 075 by weight of oil 18. At 12 GST rate the petrol price would be around Rs.

The procedure to find HS Code with tax rate is very simple. Bringing them under the GST would impact revenue generation for the states. If petrol comes under the purview of the GST the maximum rate that can be applied according to the GST law is 56 CGST 28 and SGST 28.

The procedure to find HS Code with tax rate is. Central excise and state VAT value added tax make up for almost half of the retail selling price of petrol and diesel. MV expenses - petrol which tax code should I use.

Central State government are taking Excise Vat Tax respectively on petrol Diesel. And also see Coal HSN code and GST rate. Hence you can also check GST rate for petrol.

Goods and Services Tax. Fuel Cell Motor Vehicles. 20 rows HSN Code GST Rate for Coal Petroleum other fossil fuels - Chapter 27 File with us to win your taxes Ready to File.

Yes this is true. Introduction of Fossil Fuels. 3290 and at around 25.

3810 in Delhi where the current price is over Rs. However to introduce petrol and diesel within the GST is a political call to action and it must be according to the decisions taken by both the centre and states. Central State government are taking Excise Vat Tax respectively.

GST HS Code and rates for petrol Serach GST hs code and tax rate Showing Result for petrol Find GST HSN Codes with Tax Rates Here you can search HS Code of all products we have curated list of available HS code with GST website. On your BAS you disclose either the GST-inclusive or the GST-exclusive. 0 Kudos 2 REPLIES 2.

Products and their classification under the GST rule Please note that is not the full list of products under these tax brackets. If and when the GST is applied on the petroleum products there will be only a single GST tax on petroleum products most probably at 12 GST rate which will effectively cut the prices by as much as half of the current rates. These are a few products that fall under the GST rule.

Under GST the total tax on a specific good or service has been fixed at an akin level as the sum total of central and state taxes were applicable prior to 1st July 2017 by keeping them into one of the four GST tax brackets of 5 12 18 and 28. The Centre applied a total of INR 2790 per litre of excise duty on the petrol while INR 2180 per litre on the diesel fuel. The GST slabs are 5 12 18 and 28 which is how the Government would not get the tax above a fraction of what they get now.

Assuming that fuel is charged even under the highest tax slab of 28 per cent the prices of petroleum products will fall sharply. For instance if 28 per cent GST is levied upon the dealers base price of Rs 3070 the consumer will have to shell out Rs 3930 for a litre of petrol which is Rs 31 less than the existing price. Smart Simple and 100 free filing Personalised Tax Filing experience Accurate Calculations guaranteed Helpful tips for self filing Free live chat facility Disclaimer.

Most of petroleum products are proposed to be taxed at 18 per cent under GST. Subscribe to RSS Feed. This would cause a heavy cut in the revenue for the government.

Petrol and diesel cant be expected to be taxed belowmore than 28 per cent in the current scenario as it is major revenue part of Government. What happens if GST implement on petrol diesel GST was introduced on 1st April 2017 at that time petroleum products were kept out of the preview of GST us 9 2. The Taxes on petrol and diesel in the form of Excise Duty levied by the Central govt and VAT by States account for almost 40 to 50 of the total cost price of petroleum products in India.

No Export and Import HSN Codes Prescribed. When completing your BAS you must report taxable sales and the GST in their price at. Taxable sales are sales where GST is payable.

So the central govt and State Govts gets lot of revenue through Excise Duty and VATState Sales Tax respectively. The GST regime provides five different taxation rates of 0 5 12 18 and 28 per cent. Tanks and other armoured fighting vehicles motorised whether or not fitted with weapons and parts of such vehicles.

This 28 per cent tax amount that will be levied on the pump prices will be shared between Centre and states in equal proportion. HSN Code for petrol diesel coal petroleum products and tar is provided under chapter 27 of HSN code.

Gst Tax Codes Your Daily Randomness Needs

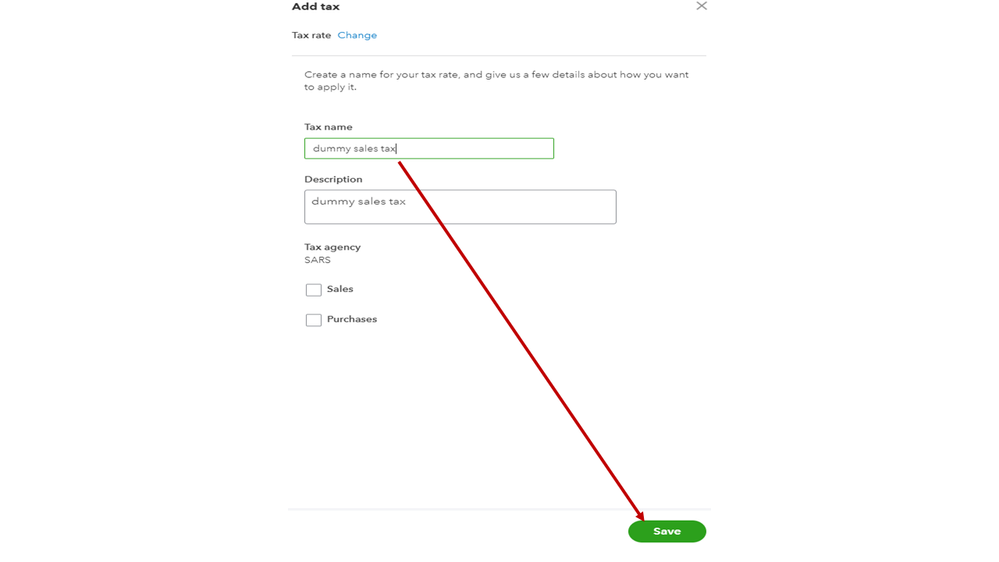

The Use Of Tax Codes When Entering Transactions Exalt

How Many Tax Codes Have Multiple Rates And Where

How Many Tax Codes Have Multiple Rates And Where

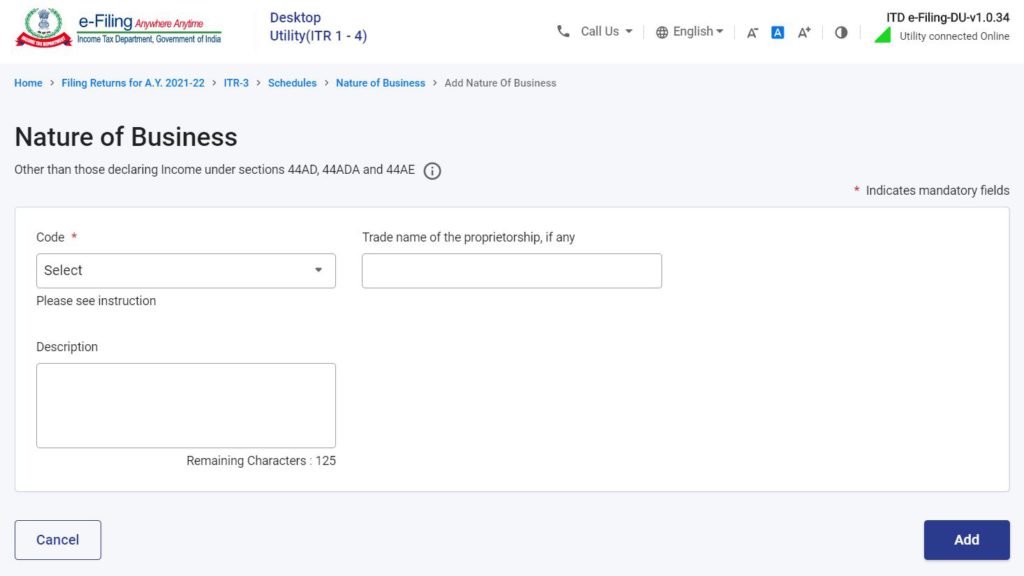

Nature Of Business And Profession Codes Updated Learn By Quickolearn By Quicko

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

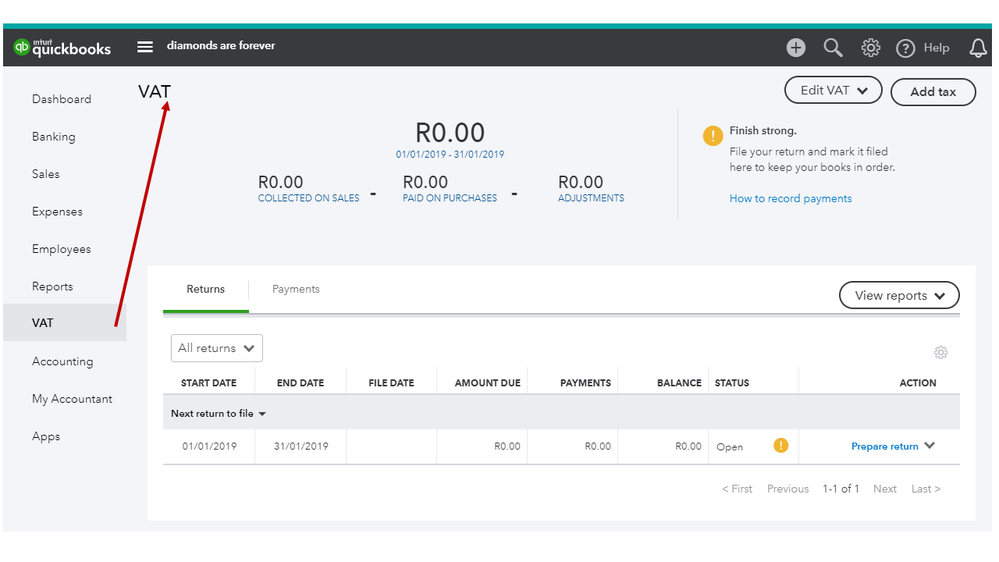

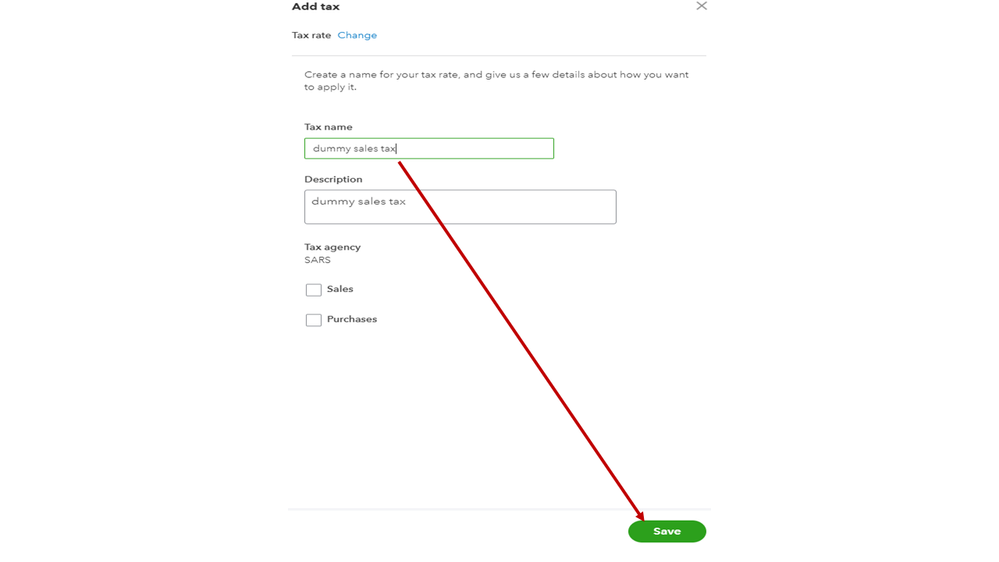

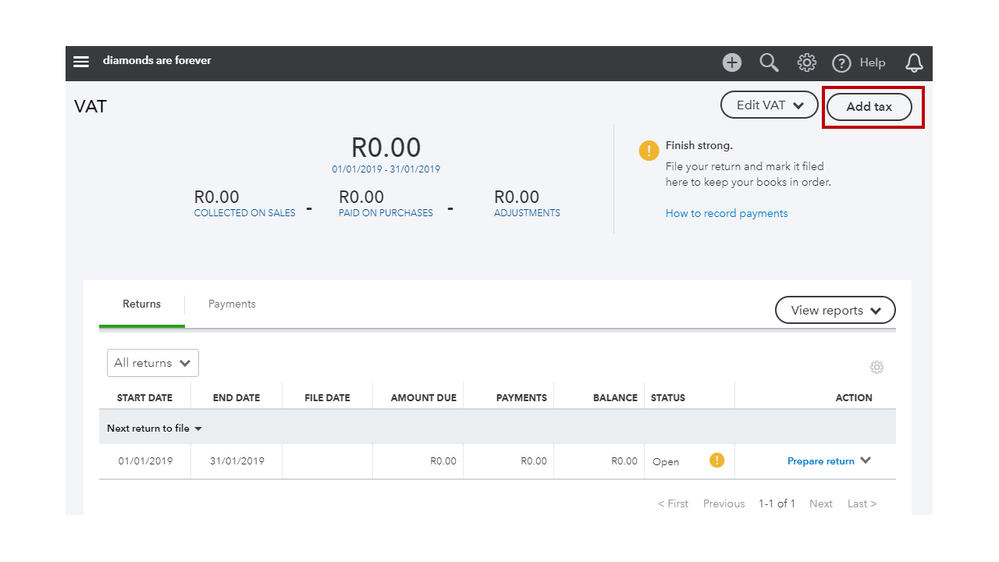

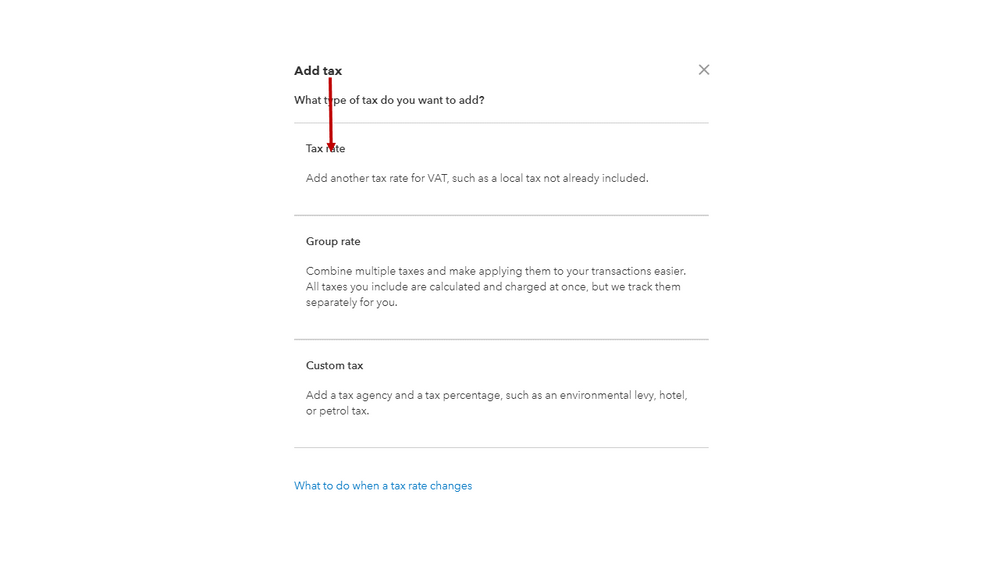

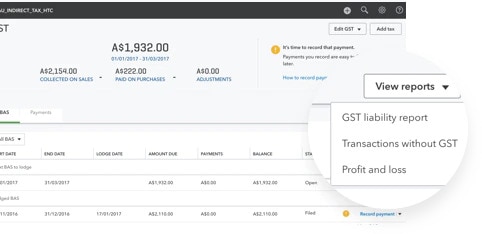

Setting Up Gst In Quickbooks Online Quickbooks Australia

Fourteenth Finance Commission Finance Economy

Tax Collected At Source Tcs In India Sap Blogs

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Tax Collected At Source Tcs In India Sap Blogs

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

How Many Tax Codes Have Multiple Rates And Where

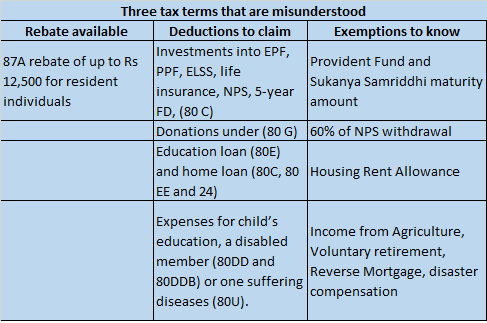

Explained How You Can Save On Taxes Via Rebates Exemptions And Deductions

Develop Business Automation With C And Entity Framework In This Project You Will Be Able To D Project Management Tools Business Automation Entity Framework

Why Is The Minimum Alternative Tax Mat Considered An Indirect Tax Even If It Is Charged To The Company Directly Quora